Supercharge your sales results by giving customers what they want. PlanPay is a new type of payment solution based in Australia that is changing how people pay for their holidays and experiences

By digitising the popular layby concept, PlanPay has been designed so consumers can travel without the financial hangover, providing personalised, flexible, upfront plans to suit the traveller’s lifestyle.

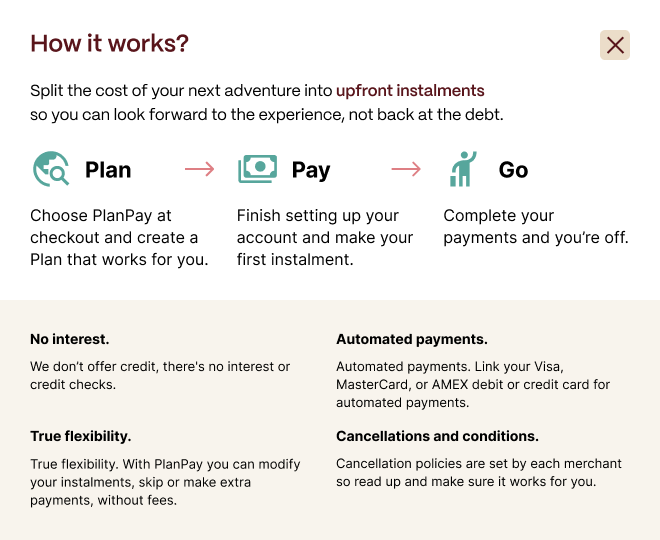

Unlike a buy now, pay later platform (BNPL) that encourages consumers to borrow credit, PlanPays digital lay-by platform allows guests to use their own money to make payment on their own terms.

By avoiding credit facilities all together, customers are free to design their own flexible plan for example, setting the automated payments to be weekly, fortnightly, or monthly to match their salary rhythm between when they book and when they intend to travel. That means you get access to a world of customers ready to do more with their money.

PlanPay is a valuable tool for travel agents to make their services more appealing and accessible to their client base. As travel resumes and more people start planning their trips, PlanPay enables travel agents to provide their clients with a convenient payment solution.

As the first digital lay-by platform available both on and offline, we offer instant approvals, no credit checks, and no penalty fees, which makes PlanPay the best way to eliminate the burden of budgeting. said Gary Burrows, CEO of PlanPay.

Specifically developed to help travellers manage their budget, PlanPay is suited to younger travellers and families who want to make memories through travel and adventure but avoid credit card debt.

PlanPay can be offered to your customers through a checkout integration or agent-assisted sale. PlanPay is now in a rapid growth phase and onboarding more merchants to the platform whether they be hotels, airlines, cruises or experiences. Recently onboarded merchants, Ovolo, Roomstay, EVT and Greenfields are taking full advantage of the benefits PlanPay has to offer whilst providing a range of perks for consumers, such as;

- Increase direct bookings and average order value: In a PlanPay study, 41% of customers said by paying in instalments an upgrade would become more appealing. By digitising layby and incorporating the flexible payment options, PlanPay merchants are able to incentivise customers to book directly with them and lock in dates on the day, rather than waiting for the full amount. Thanks to the instalments, customers are also more likely to consider the higher priced option, or that extra add-on driving up revenue for your business!

- Seamless integration into online and offline sales: PlanPay can be seamlessly integrated into both online and offline sales channels for travel agents. It can be fully customized and integrated with various travel backend systems, making the setup process quick and easy. Travel agents can offer their clients an agent-assisted check out, whether booking online or in-person, so it’s ready to use with little to no integration.

- Gain longer booking lead times: Merchants can have a 10-month average lead time when using PlanPay compared to just weeks with credit cards or pay in full. PlanPay enables clients to plan and book their trips well in advance, providing travel agents with longer lead times. Any preparations (i.e. hotel staff required) that need to be made to ensure your customer has the best possible experience are made with ease thanks to PlanPay. Conversions will no longer be an issue with the flexible split of upfront payments.

- Grow your retention by engaging customers with payment flexibility: With PlanPay, merchants can deliver financial freedom to their customer base. This can significantly help foster customer loyalty, build a regular customer base, increase customer satisfaction, and heighten the chances of referrals and by delivering financial freedom you are enabling them to commit to future travel purchases.

- Easily retarget abandoned carts; Unlike traditional payment methods. PlanPay gives a pricing incentive without discounting. Reducing your reliance on discounting to drive bookings and presenting the pricing as weekly instalments, lowering the price barrier to purchases, making the price palatable helps to retain customers and maximise bookings, helping to preventing abandoned carts.

Visit the website at https://www.planpay.com/partnerwithus.